Limited Time Offer: Use Grove for FREE this tax season. Any clients added before Jan 31st cost you nothing.

Use Grove for FREE this tax season.

Backed by

The AI Tax Workflow Automation for Modern Firms

Automate 70% of your tax prep work to handle 3x more clients and focus on high-value strategy.

Built by the creators behind

70%

Less Time Per Return

From intake to delivery, Grove handles the work that used to take your team hours. AI intake chat. Automated data entry. Smart document organization. Hours freed up on every single return.

70%

Less Time Per Return

From intake to delivery, Grove handles the work that used to take your team hours. AI intake chat. Automated data entry. Smart document organization. Hours freed up on every single return.

70%

Less Time Per Return

From intake to delivery, Grove handles the work that used to take your team hours. AI intake chat. Automated data entry. Smart document organization. Hours freed up on every single return.

3x

More Returns

Those hours aren't just savings they're capacity. Your team processes 3x more returns without working nights and weekends. Growth without burnout. That's sustainable.

3x

More Returns

Those hours aren't just savings they're capacity. Your team processes 3x more returns without working nights and weekends. Growth without burnout. That's sustainable.

3x

More Returns

Those hours aren't just savings they're capacity. Your team processes 3x more returns without working nights and weekends. Growth without burnout. That's sustainable.

95%

Client Satisfaction Rate

Clients experience faster turnarounds, clearer communication, and the feeling that you actually understand their situation. They return. They refer. They stay.

95%

Client Satisfaction Rate

Clients experience faster turnarounds, clearer communication, and the feeling that you actually understand their situation. They return. They refer. They stay.

95%

Client Satisfaction Rate

Clients experience faster turnarounds, clearer communication, and the feeling that you actually understand their situation. They return. They refer. They stay.

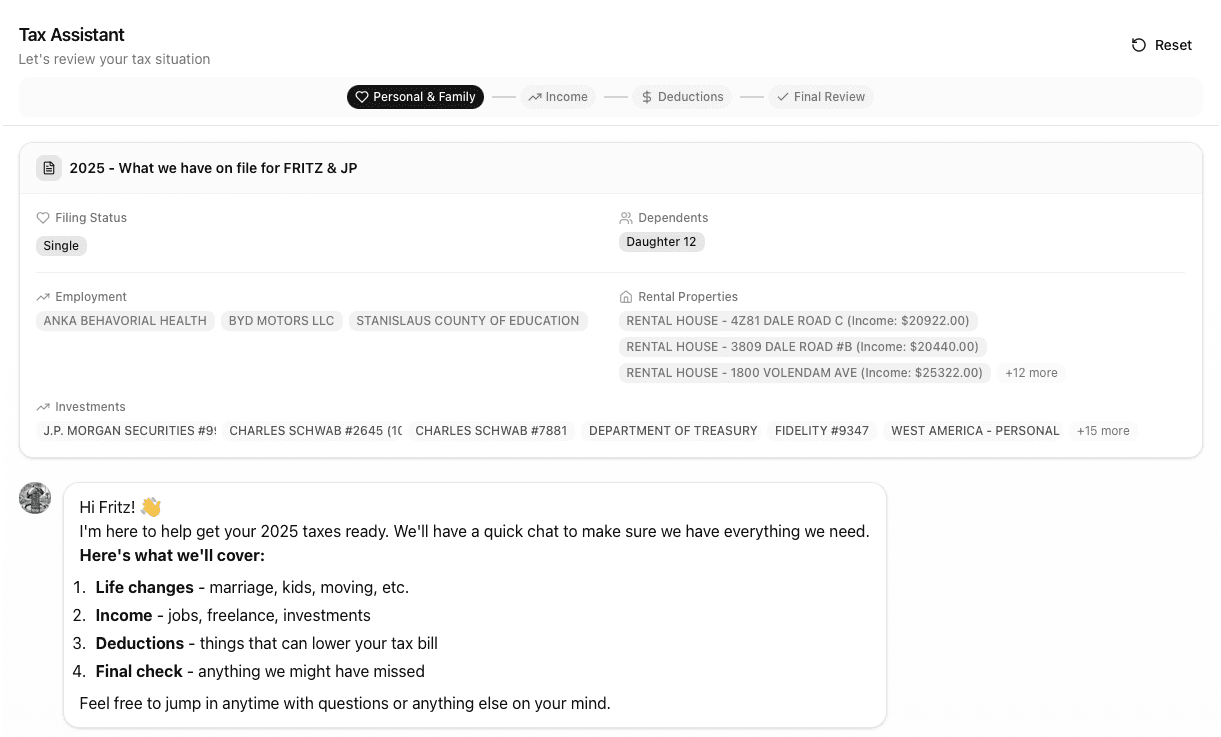

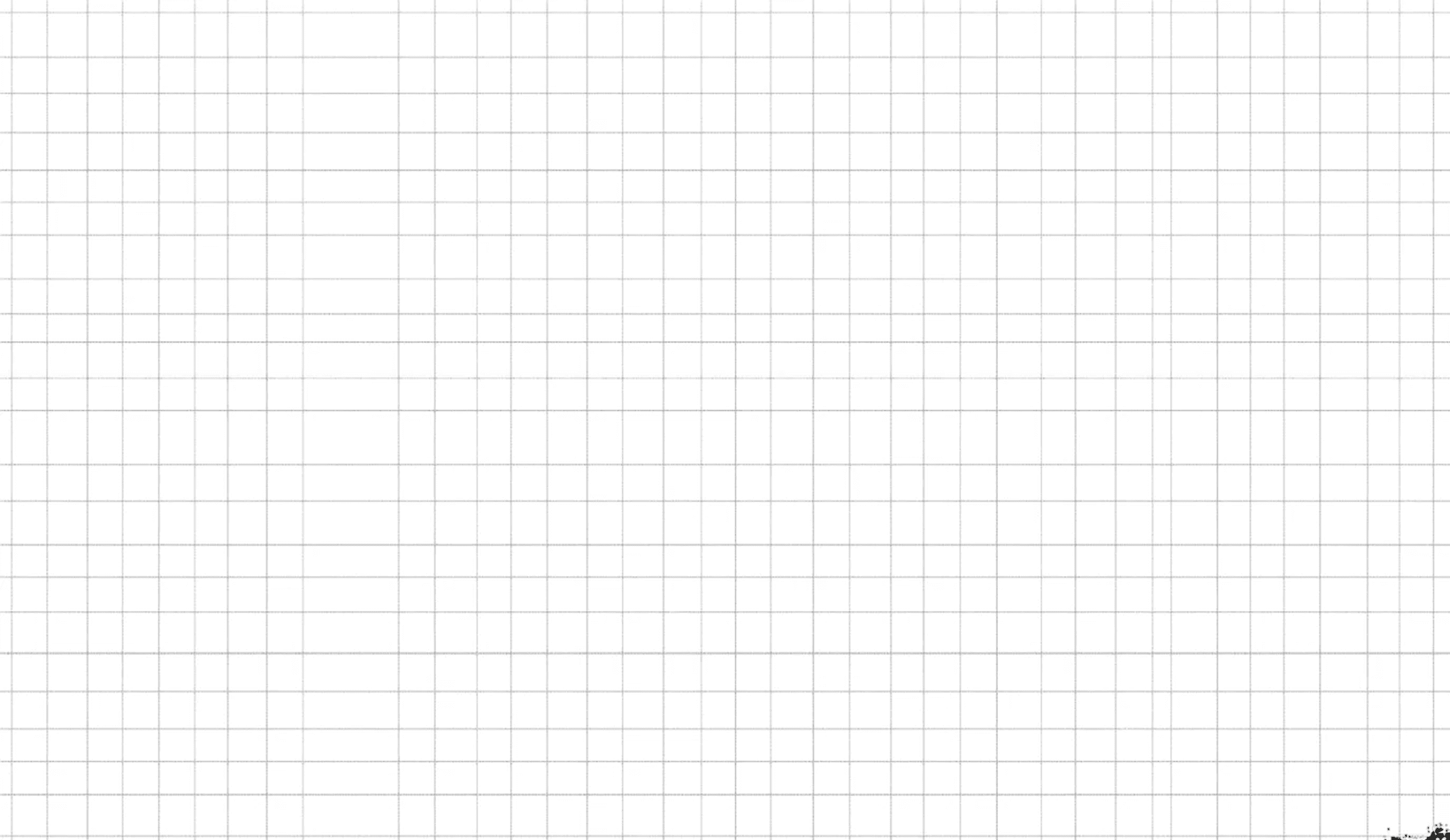

Prior Year Summary

See what matters before you start.

Income sources, deductions, dependents, properties, business details. All extracted from last year's return and organized in one view. Scan it in 30 seconds. Reference it during prep. No more digging through last year's file.

Prior Year Summary

See what matters before you start.

Income sources, deductions, dependents, properties, business details. All extracted from last year's return and organized in one view. Scan it in 30 seconds. Reference it during prep. No more digging through last year's file.

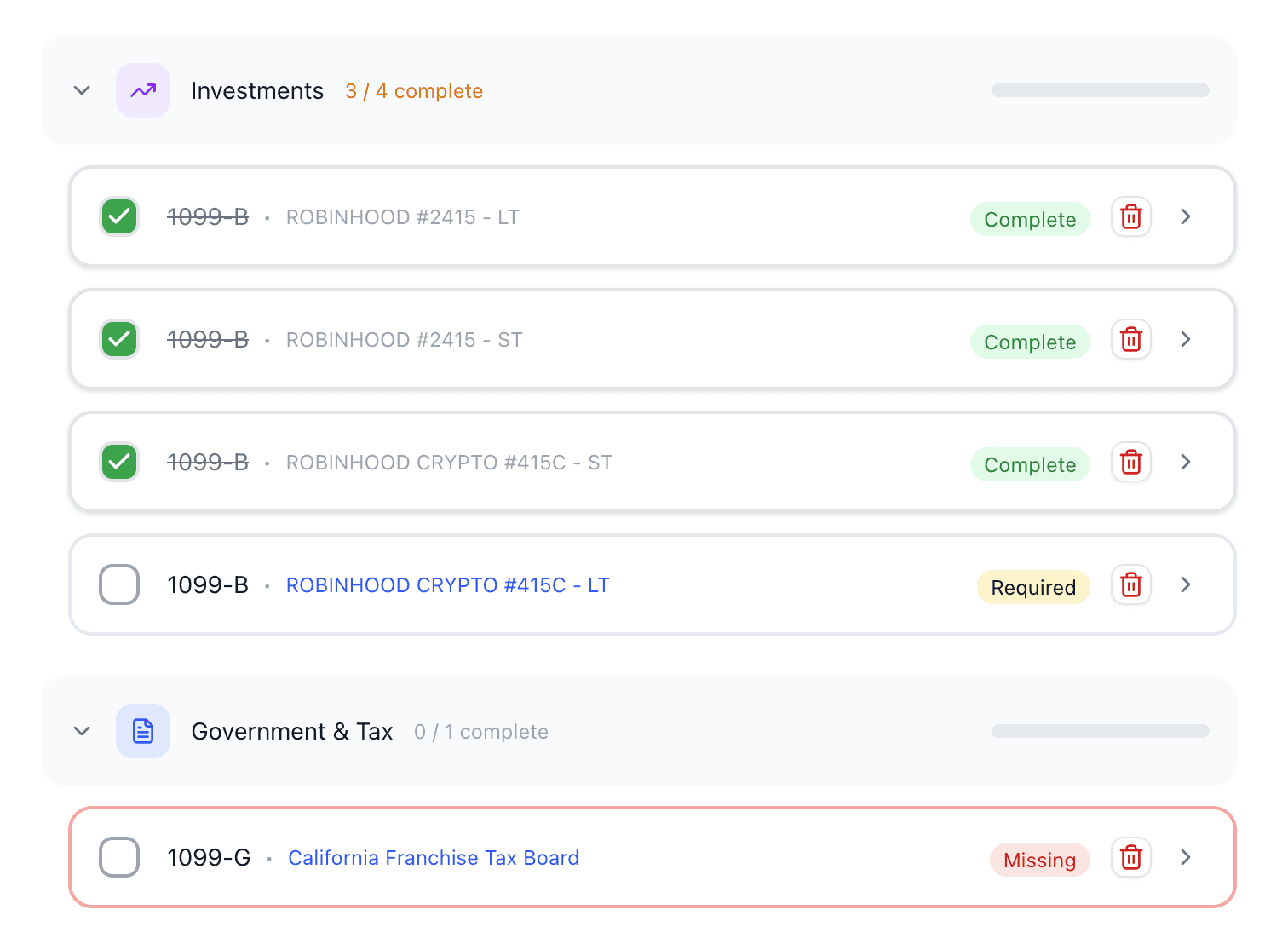

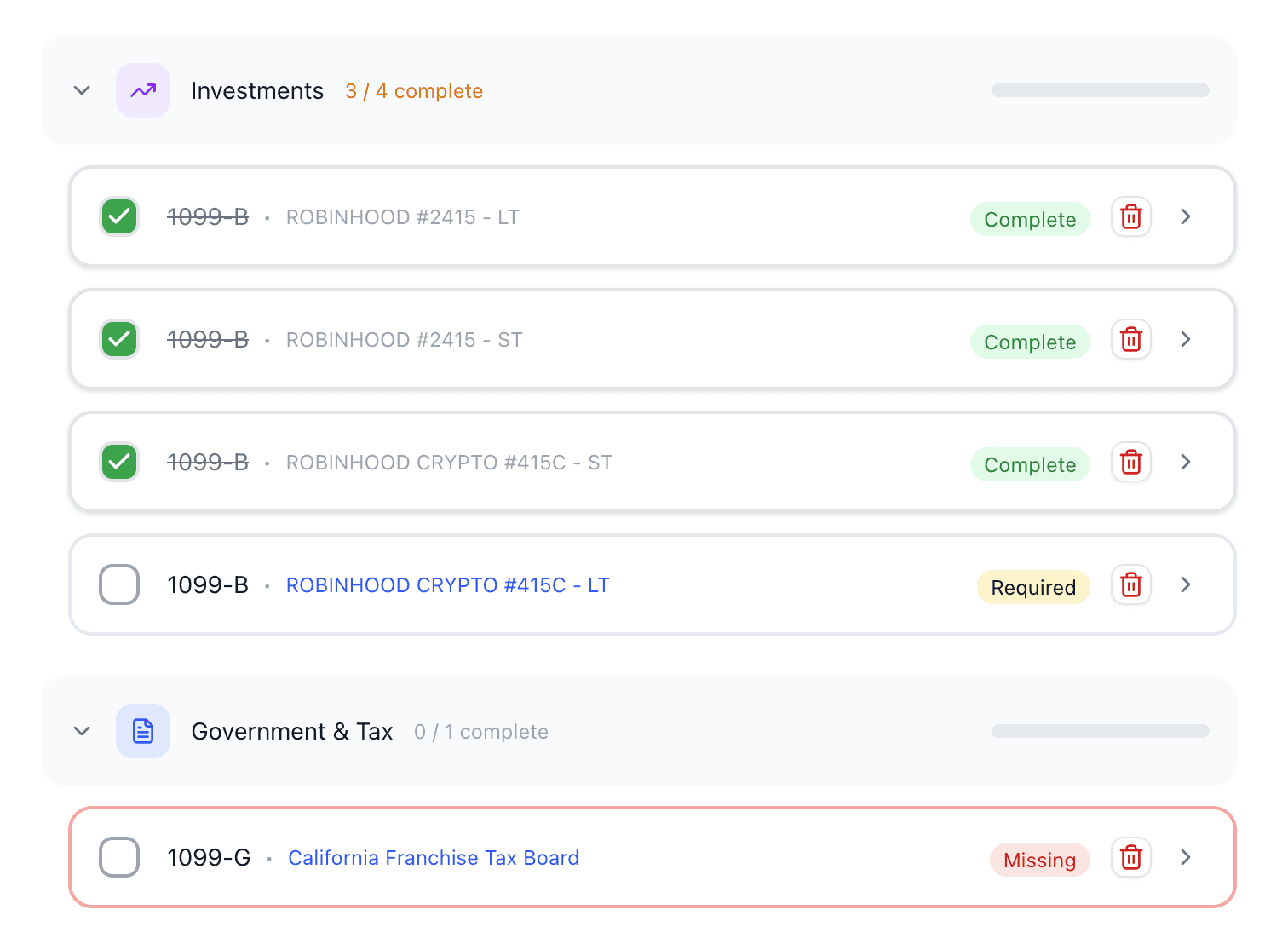

Personalized Checklists

Ask only what's needed.

We read last year's return and generate a document request list tailored to each client. Not a generic template. A checklist that reflects what they actually filed. Clients see exactly what to provide. Clients upload documents or snap a photo from their phone. You get exactly what you need.

Personalized Checklists

Ask only what's needed.

We read last year's return and generate a document request list tailored to each client. Not a generic template. A checklist that reflects what they actually filed. Clients see exactly what to provide. Clients upload documents or snap a photo from their phone. You get exactly what you need.

Workpapers

All client documents organized in return order with bookmarks, annotations, and tick marks. No more hunting through folders or jumping between apps.

1. Smart Document Recognition

Automatically identify, organize, and categorize documents by tax form type as they're uploaded.

1. Smart Document Recognition

Automatically identify, organize, and categorize documents by tax form type as they're uploaded.

Auto-Organization

Files are automatically renamed to your firm format, split into individual documents, and attached to the correct checklist items.

Auto-Organization

Files are automatically renamed to your firm format, split into individual documents, and attached to the correct checklist items.

Intelligent Flagging

Automatically flag duplicates, wrong years, and irrelevant documents so nothing slips through.

Intelligent Flagging

Automatically flag duplicates, wrong years, and irrelevant documents so nothing slips through.

Bulk Upload

Upload single or multiple files at once—the system figures out where everything goes and creates checklist items for new document types automatically.

Bulk Upload

Upload single or multiple files at once—the system figures out where everything goes and creates checklist items for new document types automatically.

Built-In Document Management

Use as your complete document repository for free for you and your client —no separate tool needed, everything organized in one place.

Built-In Document Management

Use as your complete document repository for free for you and your client —no separate tool needed, everything organized in one place.

Download What You Need

Export client copies, preparer copies, or combined PDFs in a single file, ready to share or file.

Download What You Need

Export client copies, preparer copies, or combined PDFs in a single file, ready to share or file.

Workpapers

All client documents organized in return order with bookmarks, annotations, and tick marks. No more hunting through folders or jumping between apps.

1. Smart Document Recognition

Automatically identify, organize, and categorize documents by tax form type as they're uploaded.

Auto-Organization

Files are automatically renamed to your firm format, split into individual documents, and attached to the correct checklist items.

Intelligent Flagging

Automatically flag duplicates, wrong years, and irrelevant documents so nothing slips through.

Bulk Upload

Upload single or multiple files at once—the system figures out where everything goes and creates checklist items for new document types automatically.

Built-In Document Management

Use as your complete document repository for free for you and your client —no separate tool needed, everything organized in one place.

Download What You Need

Export client copies, preparer copies, or combined PDFs in a single file, ready to share or file.

AI Questionnaire

Works for every client situation. Sole proprietor. Business owner. Multiple rentals. Investments. Life changes. Same questionnaire adapts to all of it. No maintenance. One AI questionnaire handles your entire practice.

AI Questionnaire

Works for every client situation. Sole proprietor. Business owner. Multiple rentals. Investments. Life changes. Same questionnaire adapts to all of it. No maintenance. One AI questionnaire handles your entire practice.

Return Delivery

Clients receive a personalized video summary explaining their return in plain language. A beautiful, branded presentation breaks down their tax picture. Strategic recommendations for next year. All in one experience. Signature and payment in the same place. Delivery that actually makes clients understand their taxes.

Return Delivery

Clients receive a personalized video summary explaining their return in plain language. A beautiful, branded presentation breaks down their tax picture. Strategic recommendations for next year. All in one experience. Signature and payment in the same place. Delivery that actually makes clients understand their taxes.

Experience the Future of Tax Prep

Experience the Future of Tax Prep